Riksbank survey of turnover in Swedish currency and derivatives markets

The Riksbank has completed a survey of turnover in the Swedish foreign exchange and derivatives market in April 2001. This survey is part of a larger international survey coordinated by the Bank for International Settlements (BIS) covering a total of 48 countries (1) . The surveyed turnover comprises foreign exchange contracts in the spot and derivatives markets as well as interest rate derivatives without exchange risk. This survey has been carried out previously, most recently in April 1998. The 2001 survey refers to trade on the OTC market and covers the four largest Swedish agents, whose share of the total turnover amounts to approximately 90 per cent.

The study is divided into two parts: foreign exchange market and derivatives market. The turnover in the Swedish foreign exchange market (2) has doubled compared with the previous survey in April 1998. During the same period, the turnover in Swedish derivatives market has increased by 25 per cent.

Foreign exchange market turnover

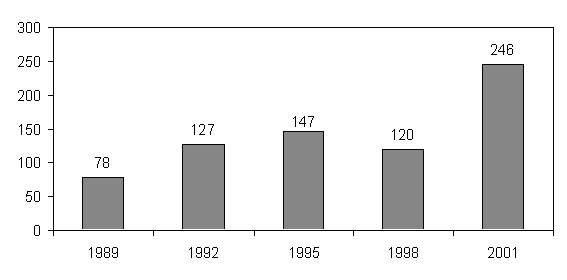

The foreign exchange market is defined as in previous BIS surveys and is represented by spot transactions plus transactions in FX swaps and outright forwards. Figure 1 shows that the average daily turnover increased by 105 per cent compared with the previous survey in April 1998.

Figure 1. Total foreign exchange turnover in the Swedish market (spot, FX swaps and outright forwards), daily average, SEK billion.

The turnover has increased in all types of foreign exchange instrument. The largest increase was in FX swaps, which are also the instrument with the highest turnover in the Swedish foreign exchange market (see Table 1).

Table 1. Turnover in the Swedish foreign exchange market by type of instrument, daily average, April 2001

A spot transaction is an agreement to buy or sell a currency for immediate delivery. In practice, delivery takes place within two days. An outright forward involves buying or selling a currency for later delivery. A swap is an agreement to buy a currency today, for example, and to sell the same currency at a future date. A swap thus consists of two transactions - a spot and an outright forward. FX swaps normally have a maturity of up to one year.

In the Swedish spot market the currency pair with the highest turnover is EUR/SEK, whereas in 1998 the most traded pair was USD/DEM and DEM/SEK took second place. Foreign exchange transactions in EUR/SEK account for 31 per cent of turnover, which can be compared with the 17 per cent for DEM/SEK in 1998. The second most important currency pair on the spot market is EUR/USD, which accounts for just under 27 per cent of turnover. This percentage is unchanged when compared with the number of transactions in USD/DEM in 1998. On the FX swap and forwards market the most important currency pair is still, as in 1998, USD/SEK (see Table 2).

Table 2. The most frequent currency pairs in the Swedish market, daily average in April 2001

Foreign banks account for almost half of the transactions with the Swedish institutes, which is a reduction of just over 10 percentage points compared with 1998. On the other hand, non-financial institutes have taken on a more important role as counterpart since 1998. These act as counterparts in approximately 10 per cent of the foreign exchange transactions, compared with around 14 per cent in the previous survey. Swedish non-financial customers were counterparts in one quarter of the foreign exchange transactions, which is the same figure as in 1998.

Table 3. Turnover in the Swedish foreign exchange market by counterpart, daily average, in April 2001

Derivatives market turnover

Derivative transactions can be divided up into interest-related contracts without exchange risk and contracts that also include exchange risk. The first category refers to forward rate agreements (FRAs), interest rate swaps and options. The second category covers currency swaps and options.

The turnover in derivative instruments has increased by approximately 25 per cent, compared with the 1998 survey and now amounts to SEK 41 billion per day on average (see Figure 2).

Figure 2. Total turnover in derivatives on the Swedish market,

daily average, SEK billion

The survey shows that, as in 1998, the interest rate instrument with the highest turnover is forward rate agreements (FRAs), (see Table 4). Turnover in FRAs has increased by approximately 37 per cent since the previous survey. An FRA is an agreement whereby two parties agree on a fixed interest rate on a deposit during a future period. Turnover in interest rate swaps has increased by almost 50 per cent. An interest rate swap is an agreement whereby the parties exchange interest rate flows with one another. Normally, this involves swapping a floating interest rate with a fixed interest rate in one and the same currency.

The turnover in interest rate options has declined by 85 per cent since 1998. An options agreement provides the holder with the right, although not the obligation, to buy (sell) an interest-bearing security or currency at an agreed point in time and for an agreed price.

With regard to interest rate instruments with an exchange risk, it can be noted that turnover in currency swaps has fallen by approximately 5 per cent. Currency swaps are an instrument whereby the counterparts exchange interest rate flows with one another, but unlike interest rate swaps these interest rates are in different currencies. They normally have a maturity of between one and ten years. The turnover for currency options has increased by almost 50 per cent.

Table 4. Turnover in derivatives in the Swedish market by type of instrument, daily average, in April 2001

On the derivatives market, as on the foreign exchange market, the largest counterparts in transactions with the Swedish institutes are foreign banks and Swedish non-financial customers (see Table 5). However, the share held by foreign banks has declined considerably since the previous survey, to the benefit of foreign financial institutes, and Swedish and foreign non-financial customers.

Table 5. Turnover in the Swedish derivatives market by counterpart, daily average in April 1998

The Swedish interest rate derivative market (FRAs, interest rate swaps and interest rate options) is dominated by contracts in Swedish interest rates. These account for just over 60 per cent of the total turnover, followed by interest rate derivatives in Norwegian and Danish currencies and in euro. The turnover in derivatives in contracts in euro interest rates has more than doubled in comparison with the turnover in derivatives in contracts in D-mark and French francs in the 1998 survey (see Table 6).

Table 6. Turnover in interest rate derivatives (FRAs, interest rate swaps and interest rate options) in the Swedish market by currency, daily average in April 2001

For further information, please contact:

Antti Koivisto, Market Operations Department phone: +46-8-787 05 08

1) BIS will publish today a compilation of all the country surveys. The Swedish study has been adjusted for double counting with regard to transactions within Sweden, but not transactions between countries. Double counting arises when two reporters each publish their mutual transactions.

2) Please note that the Swedish market is defined as institutes in Sweden.